Luxury hotels in India are often associated with glamorous establishments located near major airports in cities like Mumbai, Delhi, Chennai, and Bengaluru. But these markets are becoming increasingly saturated, prompting the hospitality industry’s biggest names to shift focus to Tier-2 and Tier-3 cities. A recent study by JLL revealed that nearly 43% of planned hotel projects are being developed in these smaller markets. In the last fiscal year, around 67% of all new hotel openings were in Tier-2 and Tier-3 cities, a number that is expected to increase to 75% next year.

In the last quarter, Spalba achieved an impressive milestone, with 70% of the hotels and banquets onboarded originating from Tier 2 and Tier 3 cities such as Pathankot, Latur, Amritsar, Faridabad, to name a few. This indicates a significant trend in the industry, where technology-driven tools like Spalba are facilitating the increased presence of luxury hotels in these smaller mark

The primary driver behind the expansion of major hotel chains into Tier-2 and Tier-3 cities is the remarkable growth potential these regions offer. As India’s economy continues to expand, these smaller cities are emerging as crucial economic centers, attracting a growing number of business travelers. Moreover, the burgeoning middle class in these cities is spurring demand for high-quality lodging and dining options.

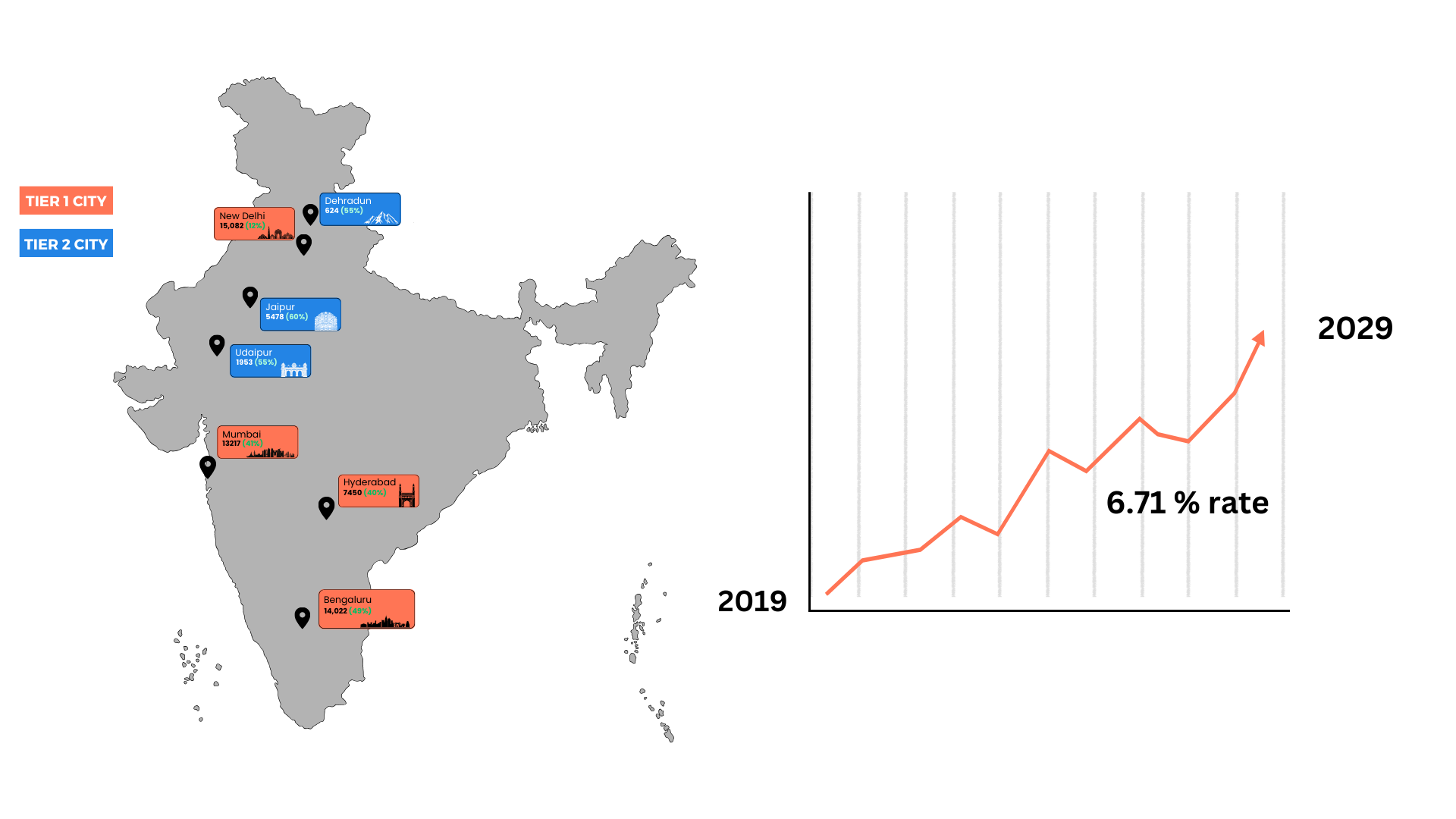

The growth of the Indian economy has led to an increase in disposable income among the middle class, resulting in higher spending on travel and tourism. According to a report from the World Travel and Tourism Council, the contribution of travel and tourism to India’s GDP is projected to grow at a rate of 6.7% per year between 2019 and 2029. This presents a significant growth opportunity for the hospitality industry, with Tier-2 and Tier-3 cities well-positioned to reap the benefits of this trend.

Social aspirations, weddings etc are also fuelling demand for banded hotels in small towns. “The Indian hospitality industry has seen a major shift in the recent past, with hotel giants such as Accor, ITC, IHCL, Radisson, and others expanding their presence in tier 2 and tier 3 cities. This move has been motivated by the tremendous growth potential of these cities and their increasing attractiveness to both business and leisure travellers. “

One of the primary investment opportunities for hotels in tier 2 and tier 3 cities is the lower cost of land and construction. Compared to the metros, the cost of real estate in these cities is significantly lower, which means that investors can build hotels at a lower cost. This also translates into lower operational costs, which can help improve the profitability of hotels in these cities.

Another investment opportunity is the growing demand for quality hotels in these cities. With increasing disposable incomes, people are willing to spend more on quality accommodation and amenities. Moreover, the increasing number of business travellers and the growing popularity of small towns as tourist destinations are fueling the demand for hotels.

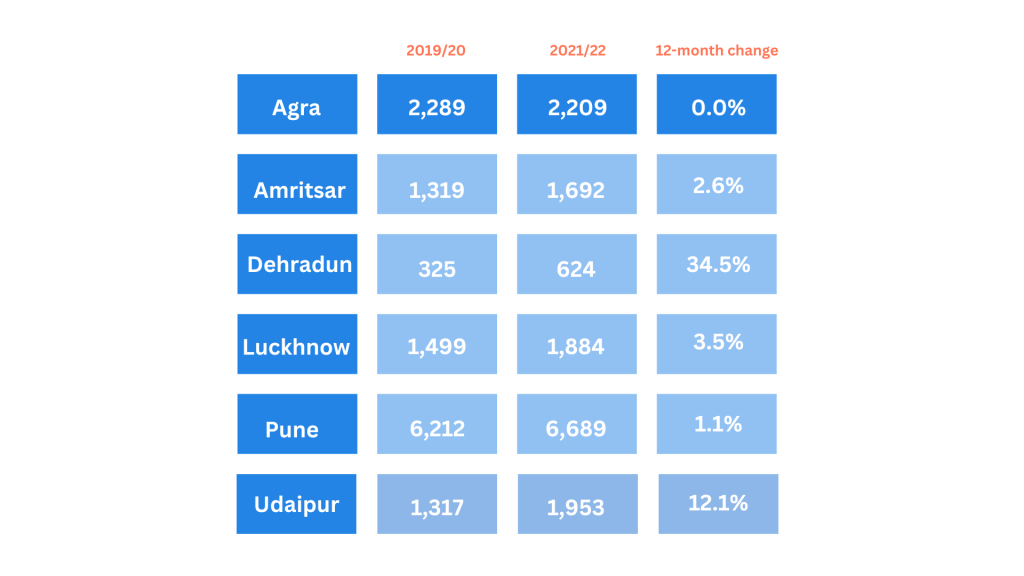

Let’s take a closer look at some of the numbers that demonstrate the growth potential of these smaller cities. According to a report, the top 10 tier 2 and tier 3 cities in India currently account for approximately 21% of the total branded hotel supply in the country. These cities are expected to see an additional 7,000 rooms added to the market over the next few years, reflecting a compound annual growth rate of approximately 8%.

Moreover, the high cost of real estate in these cities has made it difficult for new hotels to enter the market. In contrast, the lower cost of real estate in tier 2 and tier 3 cities make it easier for new hotels to enter the market and compete with existing players.